Did you get a 1099 or 5498 form in the mail?

Did you get a 1099 or 5498 form in the mail?

Here is a brief explanation of what 1099 and 5498 tax forms are.

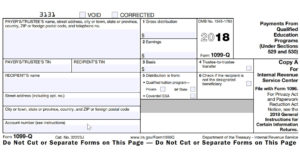

The 1099 Tax Form

…is initiated any time funds are distributed from an IRA account. This includes funds that are transferred or rolled over to another custodian, as well as the withdrawal of funds from the account. Our accounting department provides account holders with the 1099 Tax Form by January 31st of each calendar year, said forms can be found online within the account under the “Documents Tab”. These forms are also sent directly to the IRS. When it comes to learning what 1099 and 5498 tax forms are, we can help. So let’s discuss more: What is a 5498?

The 5498 Tax Form

…is initiated any time funds are received in the account. The information documented on the 5498 includes funds received from other custodians via transfer or rollover, as well as any contributions the account holder will make. Plan custodians must distribute 5498s to account holders and the IRS no later than May 31 of each calendar year—a full six weeks after the income tax filing deadline of April 15. This allows you to continue making contributions to your IRA up until April 15 and have them apply to the previous tax year. The 5498 documents can be found online within the account under the “Documents Tab”.

When funds are sent from your IRA account to another custodian, accounting generates a 1099 Tax Form. The new custodian would generate a 5498 Tax Form. The 1099 and the 5498 tax documents cancel out one another, this is what eliminates the tax liability on said funds.

For example: The account holder sends funds from Custodian A to Custodian B in the amount of $50k. Custodian A would generate the 1099 for the $50k as those funds have left the account. Once funds have arrived at Custodian B they will post the funds and generate a 5498 for the deposit of those funds. This is how the two cancel each other out, and do not create a tax liability.

What Is a 5498 and 1099?

As always since we here at uDirect IRA Services are not tax advisors we suggest you refer additional tax questions to your CPA or tax advisor for instructions or further clarity on this issue.