Many benefits come with self-directed IRAs, such as having the freedom to invest in whatever you want. However, you may be wondering how you can move money that you have from an older 401(k) or IRA. Well, it’s quite simple to roll over or transfer from an existing into a new SDIRA account. If you need some assistance on how to complete a self-directed IRA rollover, we are here to help. Follow our guide on how to do so below.

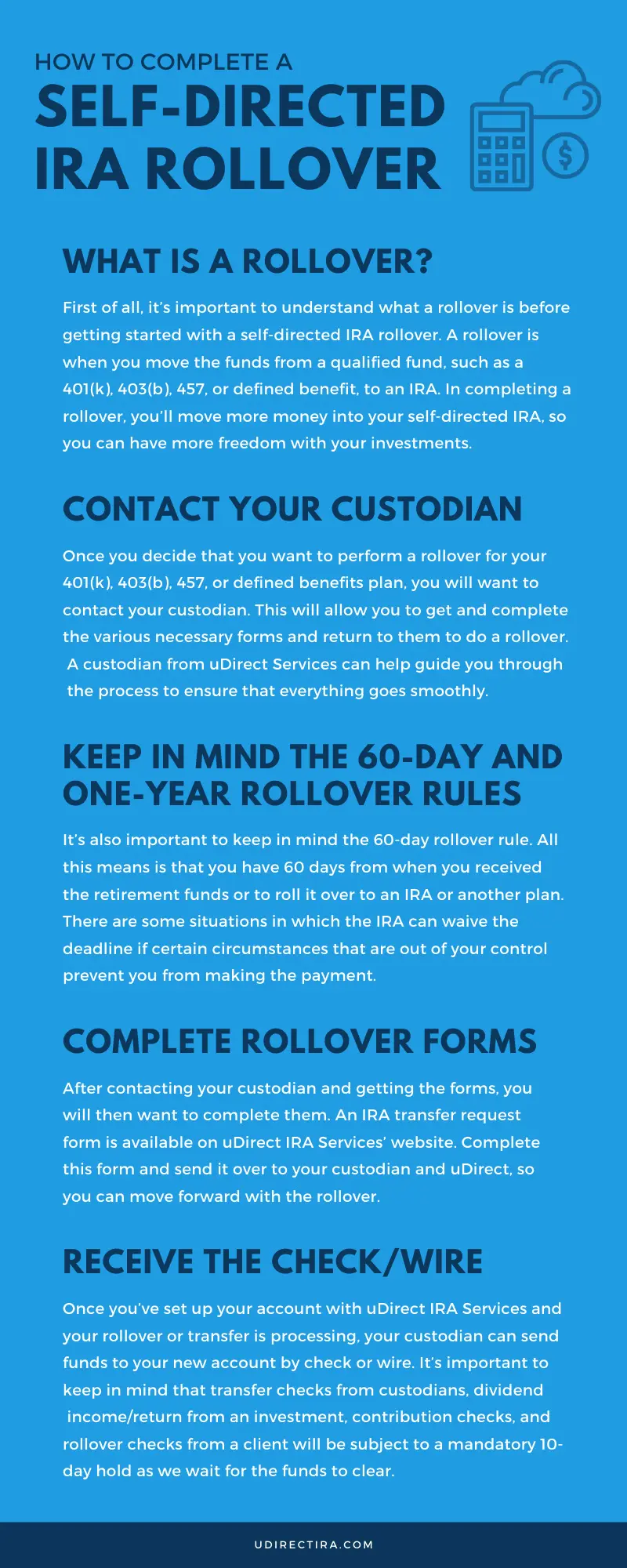

What Is a Rollover?

First of all, it’s important to understand what a rollover is before getting started with a self-directed IRA rollover. A rollover is when you move the funds from a qualified fund, such as a 401(k), 403(b), 457, or defined benefit, to an IRA. In completing a rollover, you’ll move more money into your self-directed IRA, so you can have more freedom with your investments. A major benefit of rolling over is that you typically don’t pay taxes on that money until you withdraw the funds from a new retirement plan, which means you can continue to save money, tax deferred. There are several ways you can roll over your account, including the following:

- A direct rollover is when you ask your plan administrator to disburse funds straight to another retirement plan or an IRA. You can only do a direct rollover if you are eligible. Typically, you must have left the service of the company to meet the eligibility requirements.

- If you are eligible, you can request that the financial institution that has your employer plan to transfer funds from your 401(k) to an IRA or qualified retirement plan. This is known as a trustee-to-trustee transfer, and it will not have any taxes withheld.

- The third type of rollover is referred to as an indirect rollover. This is when the distribution from the IRA or retirement plan comes directly to you. With that payment in hand, you then have 60 days to deposit all or some of the money into an IRA or retirement plan. The custodian disbursing this rollover will issue a 1099 for the amount of the withdrawal.

Contact Your Custodian

Once you decide that you want to perform a rollover for your 401(k), 403(b), 457, or defined benefits plan, you will want to contact your custodian. This will allow you to get and complete the various necessary forms and return to them to do a rollover. A custodian from uDirect Services can help guide you through the process to ensure that everything goes smoothly.

With an IRA, you will ask your current custodian to liquidate your investments to cash so the funds may be transferred.

- S corporation allocations treated as deemed distributions.

Keep in Mind the 60-Day and One-Year Rollover Rules

It’s also important to keep in mind the 60-day rollover rule. All this means is that you have 60 days from when you received the retirement funds or to roll it over to an IRA or another plan. There are some situations in which the IRA can waive the deadline if certain circumstances that are out of your control prevent you from making the payment.

There is a “one-year rule” meaning you cannot make more than one indirect rollover in a 12-month period.

Being aware of both the 60-day and one-year rules can help you stay within certain time limitations involved in completing a self-directed IRA rollover. This applies to all IRAs. So, if you take an indirect rollover from one IRA, you will have to wait one year until you can take another IRA indirect rollover. If you do another rollover during this period, that rollover is taxable to you.

Complete Rollover Forms

After contacting your custodian and getting the forms, you will then want to complete them. An IRA transfer request form is available on uDirect IRA Services’ website, and it will ask for the following information:

- IRA holder’s name and address

- Current trustee or custodian name and address

- Transfer instructions

- Cash handling instructions

- Asset handling instructions

- Signature

- Accepting IRA custodian

Complete this form and send it over to your custodian and uDirect, so you can move forward with the rollover.

Receive the Check/Wire

Once you’ve set up your account with uDirect IRA Services and your rollover or transfer is processing, your custodian can send funds to your new account by check or wire. It’s important to keep in mind that transfer checks from custodians, dividend income/return from an investment, contribution checks, and rollover checks from a client will be subject to a mandatory 10-day hold as we wait for the funds to clear. Even a check that has cleared can be “clawed-back” and therefore the 10-day hold.

Hopefully, this guide on how to complete a self-directed IRA rollover makes the process appear easier than it might have before. If you are looking to make a self-directed IRA rollover, then we ask you to consider uDirect Services, LLC. At uDirect, you will get the help and resources you desire to ensure that you receive guidance every step of the way. Then, you are free so you can invest the money the way you want to.