The Rise of 401(k) Millionaires: How Ordinary Savers are Achieving Extraordinary Wealth

Introduction

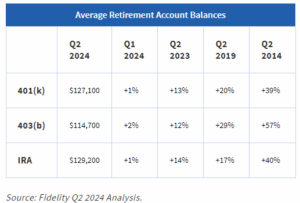

The term “401(k) millionaire” may sound like an elusive goal for many, but it has become an increasingly common milestone in recent years. A 401(k) millionaire is someone who has accumulated $1 million or more in their 401(k) retirement account. As surprising as it may seem, the number of these millionaires is growing. According to data from Fidelity Investments, one of the largest 401(k) plan providers in the United States, the number of 401(k) millionaires has been steadily increasing over the past decade. So, what’s behind this trend, and how can you aim to become a 401(k) millionaire? Let’s dive in.

The Growth of 401(k) Millionaires

There are several reasons why more people are reaching the million-dollar mark in their 401(k) accounts:

1. Stock Market Growth: The past decade has seen significant growth in the stock market, particularly in the U.S. The S&P 500, a common benchmark for U.S. equities, has delivered strong returns, boosting the value of 401(k) accounts heavily invested in stocks.

2. Increased Contribution Limits: The IRS regularly adjusts the contribution limits for 401(k) plans, allowing savers to put more money away each year. For 2024, the limit is $23,000 for those under 50, and $30,500 for those aged 50 and over, including catch-up contributions.

3. Employer Matching: Many employers offer matching contributions, which significantly enhance the growth potential of a 401(k) account. For example, if an employer matches 50% of employee contributions up to 6% of their salary, this can substantially boost retirement savings over time.

4. Automatic Enrollment and Escalation: More companies are adopting automatic enrollment and automatic escalation features in their 401(k) plans. Automatic enrollment ensures employees start saving early, while automatic escalation gradually increases the contribution rate, often annually, without requiring employee action.

5. Long-Term Saving and Compounding: The power of compounding cannot be overstated. By investing consistently over a long period, even modest contributions can grow significantly, especially when reinvested dividends and capital gains are considered.

Profile of a 401(k) Millionaire

So, who are these 401(k) millionaires? They are often ordinary people who have taken full advantage of the benefits of their 401(k) plans. Here are some common characteristics:

– Long-Term Commitment: Most 401(k) millionaires have been saving for 30 years or more. They started early, stayed committed to their savings plan, and weathered market downturns without panicking.

– Maximizing Contributions: They consistently contribute the maximum allowed or, at the very least, enough to get the full employer match. This practice not only increases their savings but also takes full advantage of tax-deferred growth.

– Diversified Investments: While the majority of their portfolios are typically invested in stocks, 401(k) millionaires often maintain a diversified mix of investments, including bonds and other assets, to balance growth and risk.

– Staying the Course: They avoid trying to time the market and instead focus on a long-term strategy. By maintaining a steady investment approach, they have reaped the benefits of market growth over time.

Tips for Aspiring 401(k) Millionaires

If you’re inspired by the idea of becoming a 401(k) millionaire, here are some strategies to help you get started:

1. Start Early: The earlier you start saving, the more time your money has to grow. Even if you can only contribute a small amount at first, the power of compounding can significantly boost your savings over time.

2. Contribute Consistently: Aim to contribute at least enough to get your employer’s full match, and consider increasing your contributions over time, especially as your income grows.

3. Invest Wisely: Diversify your investments to balance risk and reward. A mix of stocks, bonds, and other assets can provide growth while protecting your portfolio from market volatility.

4. Avoid Early Withdrawals: Taking money out of your 401(k) before retirement can severely impact your long-term savings, not to mention trigger penalties and taxes.

5. Review and Rebalance*: Regularly review your investment choices and adjust them as needed to stay aligned with your retirement goals and risk tolerance.

6. Stay Informed and Educated: Educate yourself about investing and retirement planning. The more you know, the better decisions you can make to secure your financial future.

Conclusion

Becoming a 401(k) millionaire is not just for the ultra-wealthy or financial wizards; it’s an attainable goal for those who plan and save diligently over the long term. By taking advantage of the benefits your 401(k) plan offers and sticking to a disciplined savings strategy, you too can work towards achieving this impressive milestone. Remember, the key is to start early, contribute consistently, and stay the course. With time, patience, and a sound strategy, you can turn your retirement dreams into reality.

uDirect IRA Services, LLC is here to help you~! We are not a fiduciary and we do not offer tax or legal advice. We do not recommend specific investments, rather we guide you through the process to self-direct your retirement savings into assets you choose. To get started, we offer a free consultation. Schedule yours HERE – To open an account, click HERE.