Saving for retirement isn’t just about securing your future—it can also provide significant tax benefits today. Whether you contribute to an employer-sponsored 401(k), a Self-Directed IRA (SDIRA), or a Solo 401(k), these tax-advantaged accounts can help lower your taxable income, reduce your tax bill, and even unlock additional tax credits.

Lowering Your Taxable Income with Employer Plans

One of the most immediate ways to lower your tax burden is by contributing to a tax-deferred employer-sponsored plan like a 401(k). Money pulled from your take-home pay and placed into a traditional 401(k) reduces your taxable income for the year.

For example, let’s assume:

- Your salary is $35,000

- Your tax bracket is 25%

- You contribute 6% of your salary ($2,100) into your 401(k)

Instead of paying taxes on $35,000, your taxable income is now $32,900, reducing the amount of income subject to taxation. The more you contribute, the greater the reduction in your taxable income—up to the IRS limits.

Additionally, some employers match contributions, which is essentially free money added to your retirement savings without impacting your taxable income.

Tax Advantages of Individual Plans: SDIRAs & Solo 401(k)s

If you’re self-employed or looking for investment flexibility, Self-Directed IRAs (SDIRAs) and Solo 401(k)s offer similar tax advantages with the ability to invest in alternative assets like real estate, private placements, and more.

Traditional Self-Directed IRA (SDIRA)

- Contributions to a Traditional SDIRA are tax-deductible if you meet IRS income limits.

- Your investments grow tax-deferred, meaning you won’t pay taxes on gains, interest, or dividends until you withdraw the funds in retirement.

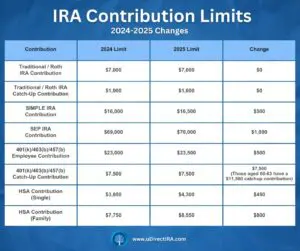

- Contribution limits for 2024 and 2025 are $7,000 ($8,000 if you’re 50 or older).

Roth Self-Directed IRA

- Unlike traditional IRAs, Roth contributions are made with after-tax dollars—but qualified withdrawals in retirement are 100% tax-free.

- While Roth IRAs don’t lower your taxable income now, they provide tax-free growth and distributions, which can be beneficial if you expect your tax rate to be higher in retirement.

- You can contribute to a Roth IRA if your income falls below the Roth limits. You’re allowed a prorated contribution if your income falls within the “phase-out” range. If your income exceeds the income range you won’t qualify for a Roth IRA contribution. Be sure to discuss your Roth contribution with your tax advisor.

Solo 401(k): The Powerhouse for the Self-Employed

For self-employed individuals, a Solo 401(k) allows for much higher contribution limits than an IRA:

- As an employee, you can contribute up to $23,000 ($30,500 if 50+).

- As the employer, you can contribute up to 25% of compensation, bringing the total contribution limit to $69,000 ($76,500 for those 50+).

Since contributions are tax-deductible, a Solo 401(k) can dramatically reduce your taxable income, making it a powerful tax-saving tool. Roth Solo 401(k) options are also available for tax-free growth.

Bonus Tax Savings: The Saver’s Credit

If you’re a low-to-moderate-income earner, contributing to a retirement account can unlock an additional tax credit—the Saver’s Credit. This credit directly reduces your tax bill and is worth up to:

- 50% of contributions (up to $2,000 per individual, $4,000 per couple) for lower-income earners.

- Available for single filers earning $36,500 or less and married couples filing jointly earning $73,000 or less (for 2024).

Check the IRS guidelines here to see if you qualify.

Final Thoughts

Strategically contributing to a retirement account not only helps you build wealth for the future but also reduces your tax burden today. Whether you’re taking advantage of an employer-sponsored 401(k), a Self-Directed IRA, or a Solo 401(k), tax-deferred or tax-free growth can significantly impact your financial future.

By maximizing your contributions, leveraging employer matches, and exploring credits like the Saver’s Credit, you can optimize your tax savings while securing long-term financial success.

uDirect IRA Services, LLC is here to help you build your retirement savings. We are not a fiduciary and we do not offer tax or legal advice. We do not recommend specific investments, rather we guide you through the process to self-direct your retirement savings into assets you choose. To get started, we offer a free consultation. Schedule yours HERE – To open an account, click HERE.