So you received an IRS Form 5498 in the mail. You may be wondering what exactly it means? Don’t worry; you’re not alone. Form 5498, often received from your IRA custodian, trustee or issuer, holds vital information regarding your individual retirement account (IRA) contributions and transactions. In this guide, we’ll delve into the details of Form 5498, shedding light on its purpose, contents, and what it means for your financial future.

Understanding IRS Form 5498

What is IRS Form 5498?

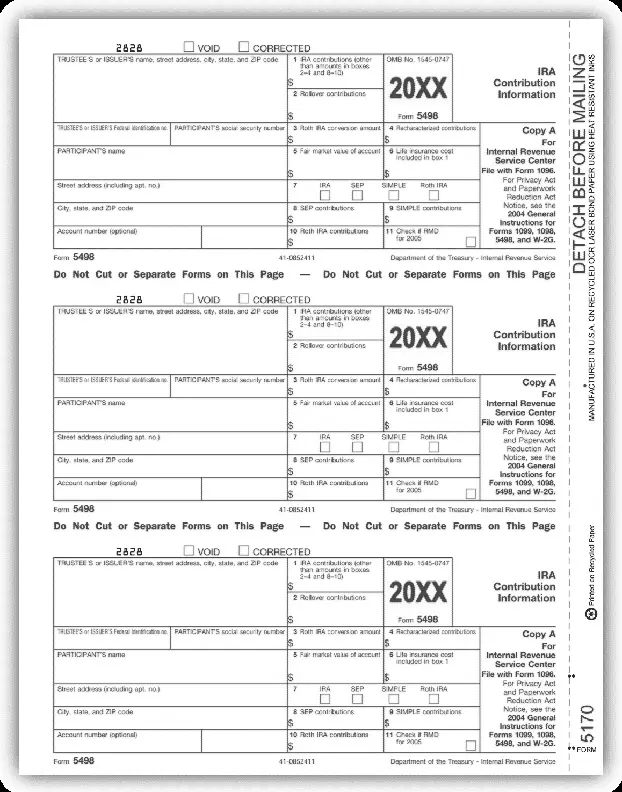

IRS Form 5498, officially known as “IRA Contribution Information,” is a tax document used to report various activities related to your IRA. These activities include contributions, rollovers, repayments, required minimum distributions (RMDs), and the fair market value (FMV) of your IRA account. Essentially, Form 5498 provides a snapshot of your IRA’s financial activity for the tax year in question.

Who Prepares Form 5498?

Form 5498 is typically prepared by the trustee or custodian of your IRA. This could be a bank, financial institution, or any other entity that manages your IRA account. Once prepared, the form is sent to both the IRS and the account holder.

When is Form 5498 Filed?

Form 5498 must be filed with the IRS by your IRA custodian before the end of May each year. This timing aligns with the fact that IRA contributions for the previous tax year are allowed until the tax filing deadline in mid-April. Therefore, the information on Form 5498 reflects the activity that occurred in your IRA during the preceding tax year.

Is Form 5498 Required for Tax Filing?

While you receive Form 5498 for informational purposes, you are not required to include it with your tax return. Instead, you should retain it for your records. However, the information provided on the form may be crucial when calculating your taxable income, especially when it comes to taking distributions from your IRA in the future.

Decoding the Contents of Form 5498

1. IRA Contributions:

Form 5498 details the contributions made to your IRA during the tax year, including any catch-up contributions allowed for individuals aged 50 and above. These contributions play a significant role in determining your eligibility for certain tax benefits and deductions.

2. Required Minimum Distributions (RMDs):

If you’ve reached the age where RMDs are required from your IRA, Form 5498 will report these distributions. RMDs ensure that retirees withdraw a minimum amount from their retirement accounts each year, as mandated by the IRS.

3. Rollovers and Repayments:

Any rollovers or repayments made into your IRA, whether from another retirement account or as a result of excess contributions, are also documented on Form 5498. These transactions may have tax implications, so it’s essential to understand how they impact your overall financial picture.

4. Fair Market Value (FMV) of the Account:

Lastly, Form 5498 provides the FMV of your IRA account as of the end of the tax year. This valuation reflects the total worth of your IRA investments and serves as a benchmark for assessing your retirement savings growth.

Conclusion: Navigating Your IRA with Form 5498

In summary, IRS Form 5498 is a document providing an overview of your IRA activity for a given tax year. While it may seem daunting at first glance, understanding its purpose and contents can empower you to make informed decisions. Remember, Form 5498 is not something to file with your taxes, but rather a valuable resource to keep on hand for future reference. By staying informed about your IRA contributions, distributions, and account value, you can take proactive steps to secure a financially sound retirement. For answers to all your self-directed retirement questions, reach out to us at uDirect IRA Services at info@uDirectIRA.com. Get started with your own self-directed account by clicking HERE.