If you have earned income from a W-2 job or self-employment, you are eligible to make an annual contribution to a Self-Directed IRA. However, there are different types of IRAs, each with differing contribution limits. Occasionally, someone will contribute more to their IRA than they were eligible for. This situation calls for the removal of an “Excess IRA Contribution”.

Correcting an Excess Contribution:

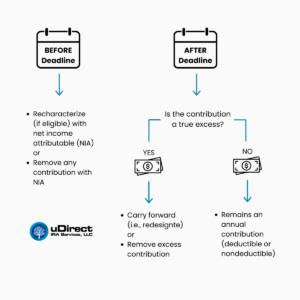

Individuals can handle excess contributions in different ways, depending on when they make the correction. An IRA owner may choose to recharacterize the contribution or remove the contribution as an excess. Further details can be found on the IRS’s website HERE. It is crucial to note that the IRA owner may be subject to a 6% excess contribution penalty tax (IRC Sec. 4973(a) & (b)). Whether the excess contribution penalty tax applies depends on when and how the individual corrects the excess contribution. Amounts rolled over after 2017 from a qualified retirement plan to a Roth IRA may not be recharacterized.

Deadline:

The deadline to recharacterize or remove an excess contribution is the IRA owner’s tax return deadline, including extensions. If the IRA owner files their tax return timely, an automatic 6-month extension applies for the tax year in which the contribution was allocated. However, the correction options available depend on whether the IRA owner corrects the excess contribution before or after the deadline. Importantly, the excess contribution can only be removed from the account in which the contribution was made and not any other IRA account that the IRA owner may have.

Conclusion:

It’s important to recognize that uDirect IRA Services, LLC, does not offer fiduciary services or provide tax, legal, accounting, investment, or professional advice. Therefore, investors should exercise due diligence and seek guidance from qualified professionals when navigating the complexities of retirement planning.

Consulting with tax or legal professionals is highly recommended when making decisions concerning retirement accounts. These experts can provide invaluable insights tailored to individual financial situations and goals. By addressing pertinent questions and seeking professional guidance, investors can make informed decisions aligned with their long-term financial objectives. To get started towards a diversified and optimized retirement portfolio, interested parties can reach out to uDirect IRA Services, LLC, at (866) 706-2798 or via email at info@uDirectIRA.com. To open an account click HERE to get started.