Are you enthusiastic about real estate investing? Do you envision building a robust portfolio of properties that generate passive income and long-term wealth? If so, then it’s time to explore the incredible potential of self-directed IRAs (Individual Retirement Accounts).

Here at uDirect IRA Services, we’re dedicated to empowering investors to make savvy financial decisions and unlock opportunities for growth. In this article, we’ll delve into how contributing to your self-directed IRA can provide you with more capital to invest in real estate. As a result, you can start turbocharging your journey towards financial freedom.

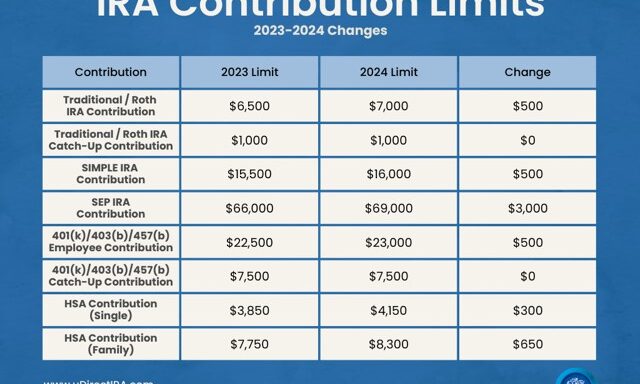

New Limits for 2024

In addition to the flexibility and tax advantages offered by self-directed IRAs, the annual contribution limits set by the IRS further bolster your ability to invest in real estate. As of 2024, individuals under the age of 50 can contribute up to $7,000 per year to their IRAs, while those aged 50 and above can make catch-up contributions of up to $8,000 annually.

Although these contribution limits may seem modest at first glance, they can add up significantly over time, especially when compounded by the power of tax-deferred growth. By consistently maxing out your annual IRA contributions and directing those funds towards real estate investments, you can supercharge your wealth-building efforts and expedite the growth of your retirement nest egg.

Alternative Asset Options

Moreover, self-directed IRAs offer the flexibility to make contributions in the form of cash or in-kind assets, such as existing real estate holdings or private mortgage notes. This opens up a world of possibilities for investors looking to leverage their existing assets to fund new real estate ventures within their retirement accounts.

Maximizing your real estate investments through self-directed IRAs is a game-changer for savvy investors seeking to build wealth and secure their financial future. By harnessing the tax advantages, flexibility, and annual contribution opportunities afforded by self-directed IRAs, you can unlock the full potential of real estate as a vehicle for long-term growth and prosperity.

Get Started

Commit yourself to empowering with the knowledge and resources you need to succeed. Whether you’re a seasoned real estate pro or just getting started on your investment journey, exploring the possibilities of self-directed IRAs can open doors to new opportunities and propel you towards your financial goals.

So, seize the moment, educate yourself on the benefits of self-directed IRAs, and take proactive steps to make annual contributions and leverage these powerful retirement accounts in your real estate endeavors. Your future self will thank you for it! To learn more, reach out to us at info@uDirectIRA.com. Get started by opening your self-directed IRA HERE.